Norwegian Cruise Line Holdings to Hold Conference Call on First Quarter 2024 Financial Results

Table Of Content

- Norwegian Cruise Line Stock Performance

- Of S&P 500 Stocks Show Upside Potential Vs. Street Estimates: Which Offers The Best Opportunity?

- Carnival CEO: Operations will proceed without a beat after Francis Scott Key bridge collapse

- Historical Prices for Carnival

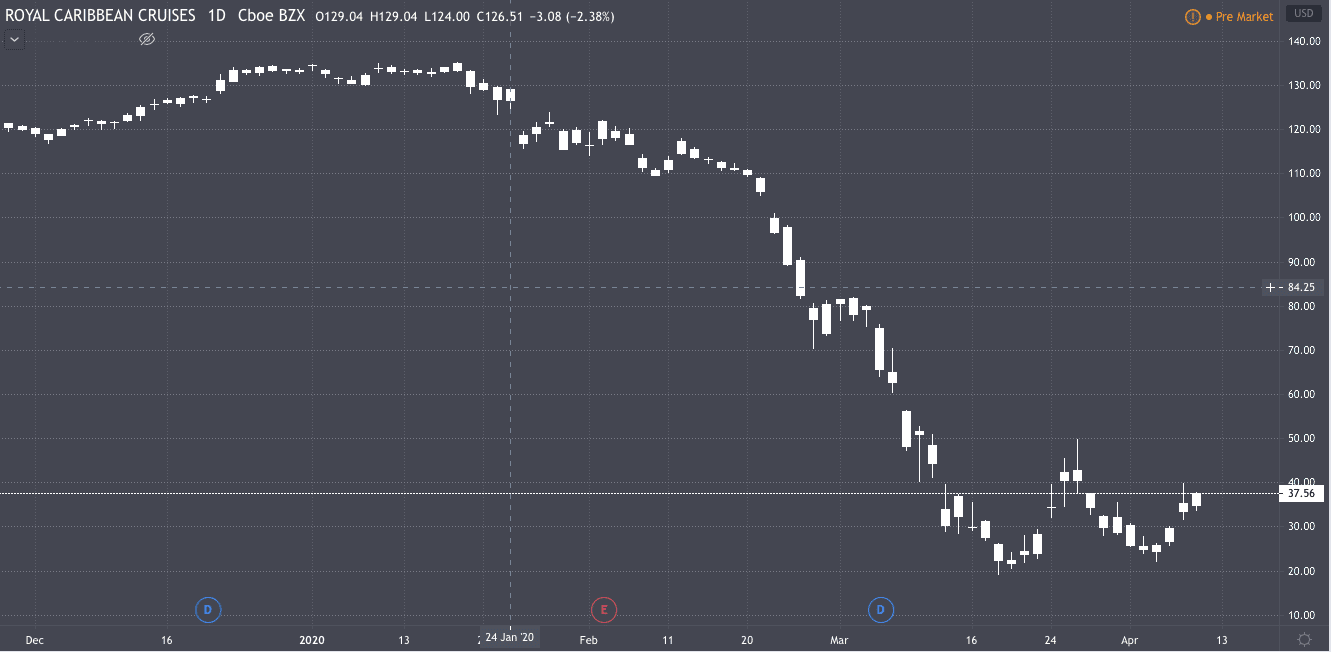

- Royal Caribbean Cruises Ltd.

- Norwegian Cruise Line Holdings

These are the cruise line stocks with the lowest 12-month trailing price-to-sales (P/S) ratio. For companies in early stages of development or industries suffering from major shocks, this can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability.

Norwegian Cruise Line Stock Performance

It will take time for the company to recover as it is still not operating at full capacity. However, if demand continues to be upbeat, the cruise line has the capacity to recover soon. Carnival Corp. (CCL) shares turned higher in intraday trading Wednesday after the cruise line posted a smaller adjusted first-quarter loss than analysts expected. According to 20 analysts, the average rating for CCL stock is "Strong Buy." The 12-month stock price forecast is $21.0, which is an increase of 48.73% from the latest price. The cruise operator said it expects the disruption to hit annual adjusted earnings by as much as $10 million.

Of S&P 500 Stocks Show Upside Potential Vs. Street Estimates: Which Offers The Best Opportunity?

The views and strategies described in our content may not be suitable for all investors. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy. While these stocks remain cyclical, industry consolidation has created a few winning companies. The cruise line has implemented some of the strictest measures to avoid COVID-19 outbreaks as its cruises resume service.

Carnival CEO: Operations will proceed without a beat after Francis Scott Key bridge collapse

Lindblad Expeditions (LIND -1.77%) isn't your typical cruise company, and that could make it a safer play than most cruise line stocks. While others carry thousands of passengers per ship, Lindblad specializes in smaller, more expensive adventure cruises. The maximum capacity for these cruises is typically between 48 and 148 passengers, depending on the trip.

MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... Founded in 1997, Viking operates cruises around the world and has 92 vessels, according to the filing. The listing would capitalize on a rebound in travel after Covid brought tourism and outdoor events to an abrupt halt. A revival in cruise bookings has sparked a boom in the sector, with shares in Royal Caribbean Cruises Ltd. doubling in value over the past year while Carnival Corp. has jumped more than 50%. With rising environmental awareness and a need to preserve the environment, demand for such expeditions should grow. Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness.

Norwegian offers a variety of cabin categories, which enables it to accommodate every type of traveler. It was the first cruise line to offer studios exclusively for solo travelers, and it has lodging fit for everyone from people sailing on their own to large families. Norwegian Cruise Line Holdings (NCLH 0.66%) is a hit among casual cruisers and is known for its laid-back atmosphere. Norwegian offers what it calls "freestyle cruising," meaning its cruises have no dress codes, no set dining times, and no assigned seating.

Carnival Cruise Lines Stock: Buy, Sell, or Hold? - The Motley Fool

Carnival Cruise Lines Stock: Buy, Sell, or Hold?.

Posted: Fri, 08 Dec 2023 08:00:00 GMT [source]

The market performance number above and all statistics in the tables below are as of Oct. 4, 2022. Below, we look at the top three cruise line stocks with the best value, fastest growth, and best performance. Considering how much the pandemic continues to affect cruise lines, investing in them is relatively risky.

Finally, Stifel Nicolaus restated a "buy" rating and issued a $25.00 price objective on shares of Norwegian Cruise Line in a report on Tuesday, April 9th. Two investment analysts have rated the stock with a sell rating, nine have given a hold rating, three have given a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, Norwegian Cruise Line has an average rating of "Hold" and a consensus target price of $20.87.

Should Investors Still Buy Carnival Cruise Stock Right Now, Even After Shares Doubled? - The Motley Fool

Should Investors Still Buy Carnival Cruise Stock Right Now, Even After Shares Doubled?.

Posted: Sat, 30 Mar 2024 07:00:00 GMT [source]

As long as leisure cruising remains upbeat, the company’s performance will improve further. The company provides expedition cruising and adventurous travel opportunities through its fleet of ten owned expedition ships and five seasonal charter vessels. Most of its guests are small groups of affluent people who are extremely loyal. Most of its expeditions are expensive, ranging between $5,000 and $25,000, depending on the itinerary. Despite a strength in demand, the bottom line remains weak due to a significant amount of leverage.

The company’s Disney+ and other streaming services have gained significant consumer traction in the past couple of years. With limited operational capacity and strong demand, the company is gaining through higher pricing, mostly driven by on-board bundled offers. As a result, it is ramping up its capacity to take nine more ships through 2027. Management expects occupancy rates to improve amid high demand and hopes to achieve record net yields for the full year of 2023. The company and the investors are offering 44 million shares between $21.00 and $25.00 per ordinary share.

That being said, cruise line stocks are still a long-term play that could have some rough seas ahead. Revenue for each of the three largest cruise lines declined by between 73% and 80% in 2020. Although the cruise industry's annual revenue almost doubled in 2021 (from $3.36 billion to $6.65 billion), it's still far from the $27.5 billion reported in 2019. While many travel companies were affected by the pandemic, cruise lines were some of the most severely hurt. Cruise ships were docked for more than a year, causing their owners to miss out on billions of dollars in earnings. Disney has a track record of delivering solid growth in revenues and profits.

Most recently, CCL reported positive developments in its second quarter (Q2) 2022 business update. Total revenues increased almost 50% from the first quarter to $2.4 billion, driven by a strong demand for cruises. Reflecting this, occupancy rates have increased to 69% from the 54% reported in the last quarter. However, rising fuel prices driven by inflation and increased debt burdens due to Covid-19 have put the industry under pressure. The industry came to a complete standstill in 2020 when the government imposed restrictions on travel and social gatherings in an effort to curb Covid-19 infections.

Viking is seeking to sell 11 million shares and the shareholders a further 33 million on a combined basis. With the economy normalizing and a pent-up demand for travel, the company plans to expand its cruise line business by adding three more ships this year. OSW ended the quarter with $30.9 million in cash and $13 million available under its credit facility. Given its cash burn rate of $1.9 million in Q1 2022, it has sufficient liquidity to carry out its business plans.

The cruise line business has high operating costs, and many cruise companies have lost a lot of money. Investors in search of safe stocks may want to stay away from this industry right now. However, cruise line companies are reporting strong sales for upcoming cruises, which indicates a rebound in demand. But they've also had to take on significant debt to get through the pandemic, and revenues aren't predicted to get back to pre-COVID numbers until 2024. Even when cruise lines have built some momentum, news of potential travel restrictions caused by the delta and omicron variants have sent their stock prices tumbling.

Comments

Post a Comment